Airbnb Financing Tips for Queen Creek, AZ Investors

Thinking of turning a cozy Queen Creek property into a cash-flowing Airbnb? You're not alone. Short-term rentals in the area are growing in popularity—and for good reason. But before you break out the shiplap and coffee bar, let’s talk about the financing side of things.Getting a home loan for an Airbnb isn’t quite like buying your everyday house. But don’t worry—we’ll walk you through the key tips that’ll set you up for success in Queen Creek, AZ.

Why Queen Creek Is Airbnb Gold

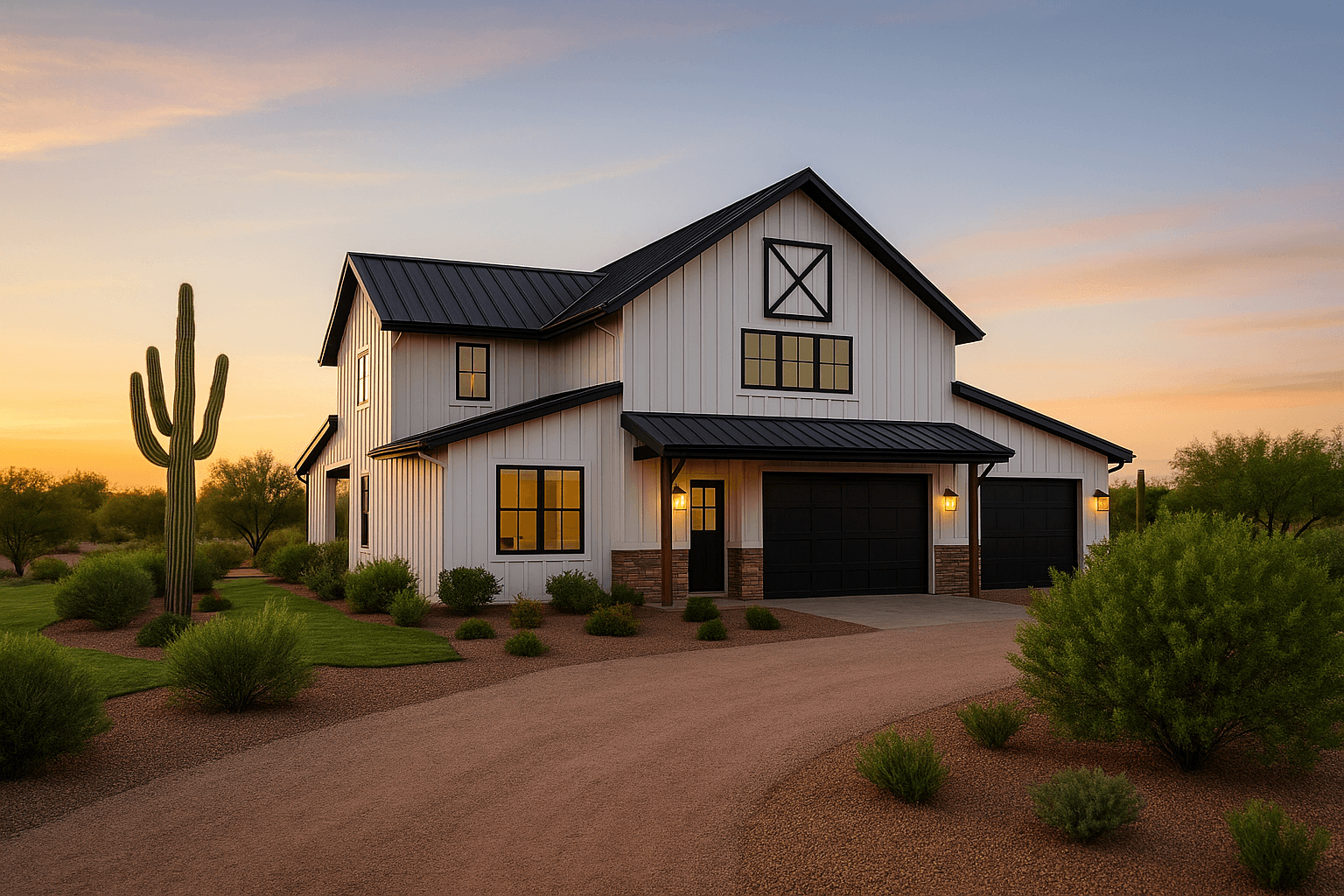

Queen Creek is one of Arizona’s hidden gems. Visitors love the quiet suburban charm, access to hiking, family attractions, and its proximity to both Phoenix and Mesa. That makes it a sweet spot for Airbnb guests who want something a little more peaceful than staying in the city.

But owning an Airbnb here isn’t just about location—it’s about smart planning, especially when it comes to financing.

💰 Airbnb Financing Tips You Shouldn’t Skip

1. Conventional vs. DSCR Loans

Most Airbnb investors go one of two routes:

Conventional Loans – These work well if you have strong personal income and plan to manage the property yourself.

DSCR Loans – These are designed just for investors. Instead of verifying your income, lenders look at the property’s potential to generate rental income. Perfect for short-term rentals!

A good mortgage broker (hello, Brick Mortgage!) can help you compare the two and choose what fits your strategy best.

2. Factor in Seasonality

Even the best Airbnb in Queen Creek will have busy and slow seasons. Make sure your loan is structured with realistic expectations—not based on peak-season rent only.

We’ll help you look at local rental comps, average nightly rates, and occupancy trends so your investment doesn’t turn into a money pit during the slower months.

3. Know the Rules

Before you buy, check Queen Creek’s short-term rental regulations. Some HOAs don’t allow Airbnb. Others have minimum stay requirements or restrictions on signage, parking, or permits.

We’ll connect you with local experts who know the ins and outs before you close the deal.

4. Get Pre-Approved Early

When it comes to investment properties, sellers take you more seriously when you’re already pre-approved. Plus, the Queen Creek market moves fast—don’t miss out on a great deal because you waited too long on financing.

🧠 Why Work With a Local Mortgage Broker?

At Brick Mortgage, we specialize in helping Queen Creek investors find smart, creative financing solutions—especially for short-term rentals and Airbnb properties.

We partner with multiple lenders, including those offering DSCR loans, bank statement loans, and other non-traditional programs ideal for Airbnb buyers.

🔑 Let’s Make Your Airbnb Dream Happen

Whether it’s your first Airbnb or your fifth, you need a loan that works for your business model—not against it. Brick Mortgage is here to walk you through the numbers, the loan options, and the strategy that turns your Queen Creek property into a profitable short-term rental.

📍 Start here. Start local. Start smart. Let’s talk about your Queen Creek Airbnb plans today.