First-Time Homebuyers in Queen Creek, AZ: Your Guide with Brick Mortgage

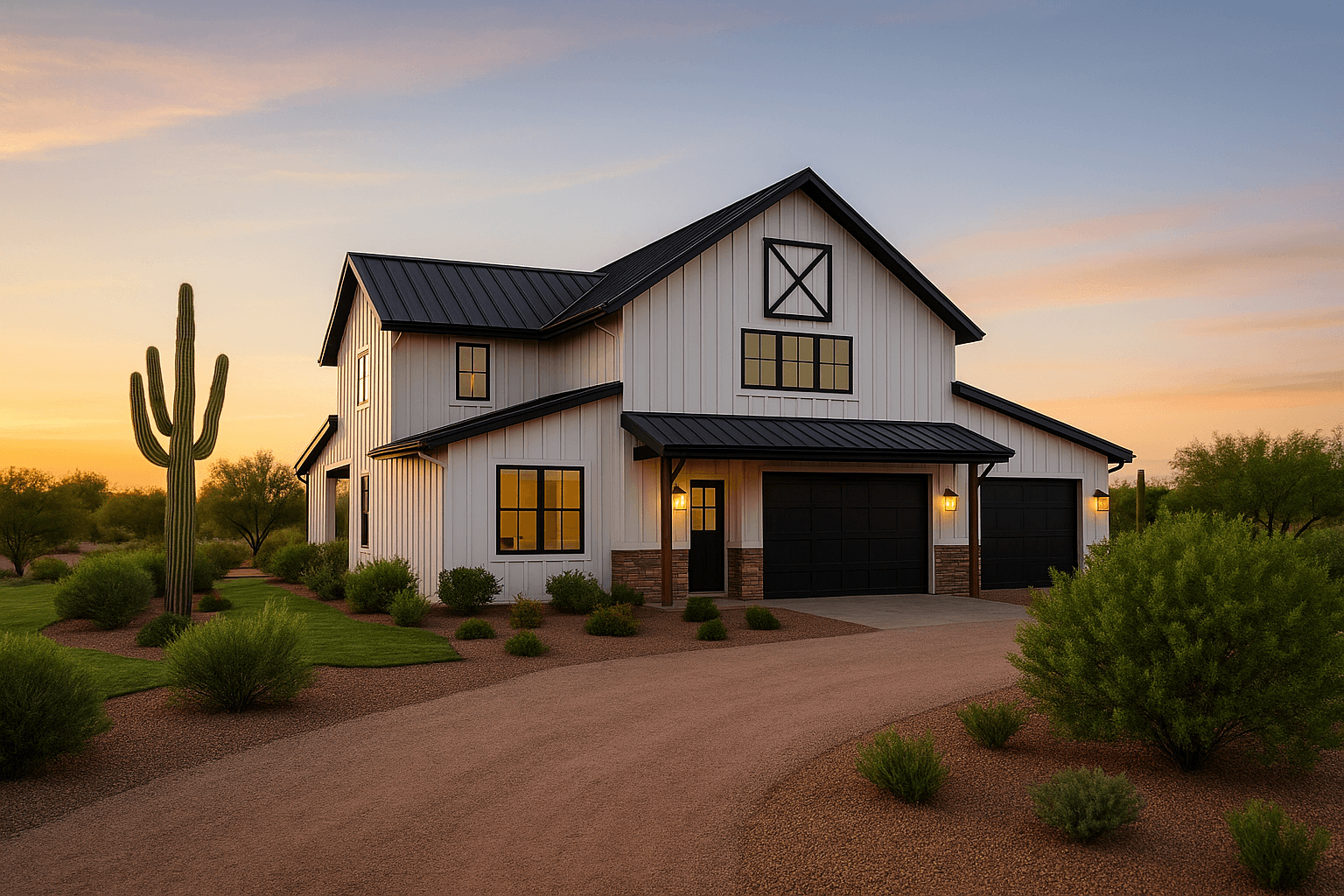

Buying your first home is an exciting milestone, and Queen Creek, AZ, is an ideal place to start your homeownership journey. With its affordable housing, family-friendly vibe, and booming real estate market, Queen Creek offers first-time buyers a welcoming community to call home. At Brick Mortgage, we’re here to guide you through every step of the process with personalized support and financing options tailored to first-time homebuyers. This blog post explores why Queen Creek is perfect for new buyers in 2025 and how we can help you achieve your dream of owning a home.

Why Queen Creek is Great for First-Time Homebuyers

Queen Creek combines small-town charm with modern amenities, making it a top choice for first-time buyers. Here’s why:

Affordable Housing Options

Compared to nearby cities like Scottsdale or Gilbert, Queen Creek offers more budget-friendly homes, with median prices in 2025 that are accessible for first-time buyers. From cozy starter homes in Harvest to modern townhomes in Encanterra, there’s something for every budget.

Growing Community

Queen Creek is a fast-growing town with new developments, excellent schools, and family-oriented neighborhoods. Events like the Queen Creek Farmers Market and Schnepf Farms festivals create a tight-knit community perfect for young buyers starting out.

Convenient Location

Located just 45 minutes from downtown Phoenix, Queen Creek offers easy access to major employment hubs while maintaining a relaxed, suburban feel. The Loop 202 and nearby amenities like Queen Creek Marketplace make daily life convenient.

Outdoor Lifestyle

First-time buyers who love the outdoors will enjoy Queen Creek’s proximity to the San Tan Mountains, with hiking, biking, and equestrian trails at San Tan Mountain Regional Park. Local parks like Mansel Carter Oasis Park add to the town’s appeal.

The Queen Creek Real Estate Market in 2025

Queen Creek’s real estate market is thriving, offering opportunities for first-time buyers. Key trends include:

New Construction: Master-planned communities like Barney Farms and Legado feature affordable new homes with modern designs, perfect for first-time buyers.

Rising Home Values: Queen Creek’s growth is driving steady appreciation, making it a smart investment for long-term homeowners.

Competitive Market: High demand means homes can sell quickly, so pre-approval and a trusted lender like Brick Mortgage are essential.

Diverse Options: From single-family homes to low-maintenance condos, Queen Creek caters to a variety of first-time buyer needs.

Financing Options for First-Time Homebuyers

Navigating mortgage options can feel overwhelming, but Brick Mortgage makes it simple. Here are popular loan programs for first-time buyers in Queen Creek:

FHA Loans

What They Are: Backed by the Federal Housing Administration, FHA loans are designed for first-time buyers with lower credit scores or limited savings.

Benefits: Low down payments (as little as 3.5%), flexible credit requirements, and competitive rates.

Best For: Buyers with smaller down payments or less-than-perfect credit.

VA Loans (for Eligible Veterans)

What They Are: VA loans, backed by the Department of Veterans Affairs, are available to eligible veterans, active-duty service members, and surviving spouses.

Benefits: No down payment, no private mortgage insurance (PMI), and lenient credit standards.

Best For: First-time buyers who are eligible veterans or military members.

Conventional Loans

What They Are: Standard mortgages not backed by the government, often with low down payment options for first-time buyers.

Benefits: Flexible terms, competitive rates, and programs like 3% down for qualified buyers.

Best For: Buyers with strong credit and some savings for a down payment.

Down Payment Assistance Programs

Arizona offers several down payment assistance programs, such as the Home Plus program, which provides grants or low-interest loans to help cover down payments and closing costs. Brick Mortgage can help you explore these options.

How Brick Mortgage Can Help First-Time Buyers

At Brick Mortgage, we specialize in guiding first-time homebuyers in Queen Creek through the homebuying process. Here’s how we support you:

Personalized Guidance: We explain every step, from pre-approval to closing, ensuring you feel confident and informed.

Local Expertise: Our team knows Queen Creek’s neighborhoods and market trends, helping you find a home that fits your budget and lifestyle.

Pre-Approval Advantage: Getting pre-approved with Brick Mortgage strengthens your offer and helps you compete in Queen Creek’s fast-moving market.

Tailored Financing: We match you with the best loan program, whether it’s FHA, VA, or conventional, and explore down payment assistance options.

Tips for First-Time Homebuyers in Queen Creek

Get Pre-Approved Early: Work with Brick Mortgage to get pre-approved, so you know your budget and can act quickly when you find the right home.

Explore Neighborhoods: Visit communities like Madera, Ironwood Crossing, or Cadence to find the vibe that suits you.

Budget Wisely: Factor in all costs, including down payment, closing costs, and monthly expenses like HOA fees or utilities.

Partner with a Realtor: A local real estate agent familiar with Queen Creek can help you navigate the market and negotiate offers.

Think Long-Term: Queen Creek’s growth makes it a great investment, so consider how your home choice aligns with your future plans.

Conclusion

Queen Creek, AZ, is a fantastic place for first-time homebuyers, offering affordable homes, a welcoming community, and a bright future. With the right financing and support from Brick Mortgage, you can turn your dream of homeownership into reality in 2025. Whether you’re exploring FHA, VA, or conventional loans, our team is here to guide you every step of the way.

Ready to buy your first home in Queen Creek? Contact Brick Mortgage today to get pre-approved and start your journey to homeownership in this vibrant Arizona town!