Who Should You Call First in Queen Creek, AZ: A Loan Officer or a Real Estate Agent?

If you’re buying a home in Queen Creek, AZ, you may wonder: do I start with a loan officer or a real estate agent? Here’s the smart (and stress-free) way to begin.

Let’s Be Honest: The House Hunt Starts With the Money

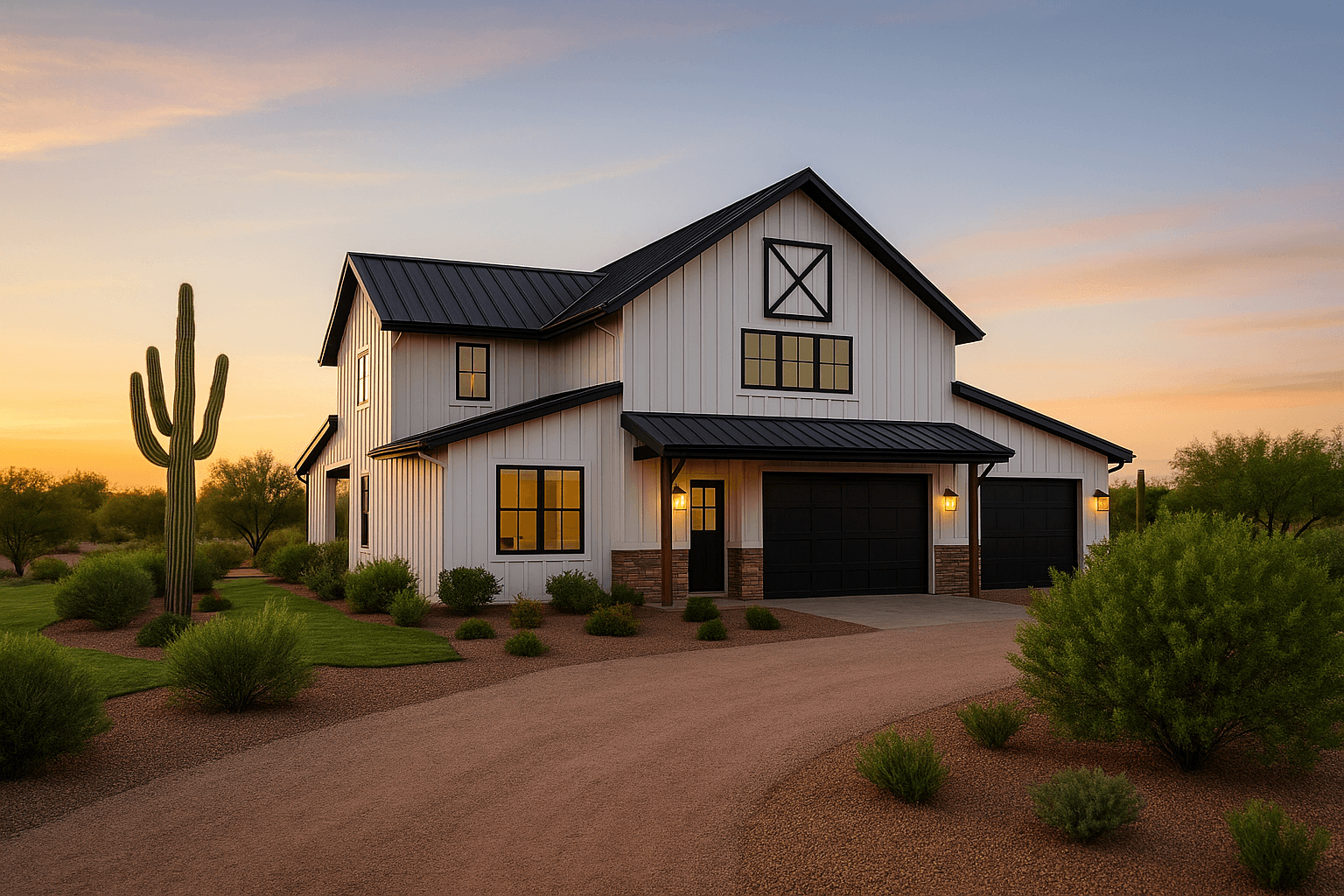

You can scroll listings for days, fall in love with that perfect white farmhouse, and imagine backyard BBQs under the Arizona sunset—but none of that matters if you don’t know what you can actually afford.

That’s why your first call should be to a loan officer, not a real estate agent.

Why a Loan Officer Comes First

A loan officer helps you:

Get pre-approved for a home loan

Understand your true buying power

Break down what monthly payments will look like

Compare mortgage options (FHA, VA, Conventional, etc.)

Avoid wasting time on homes outside your price range

When you're pre-approved, real estate agents take you seriously—and so do sellers.

At Brick Mortgage, we give you clarity, confidence, and a fast pre-approval so when the right home hits the market, you’re ready to act.

What Happens Next?

Once you’re pre-approved, we’ll even connect you with trusted real estate agents in Queen Creek we’ve worked with for years. Agents love working with buyers who are already financially prepared—it makes the whole process smoother for everyone involved.

Why Work With Brick Mortgage First?

✅ We’re based in Queen Creek

✅ We know the local real estate market

✅ We work with agents across town

✅ We’ll give you honest numbers you can count on

We’re not here to rush you—we’re here to prepare you.

📞 Thinking about buying a home in Queen Creek, AZ? Let’s talk first. At Brick Mortgage, we’ll make sure you’re ready to shop with confidence and connect you with the right agent when the time comes.