Why Mortgage Brokers Are Better Than Banks When Buying a House

When you’re buying a home, one of the first big decisions is where to get your mortgage. Do you go straight to your bank, or do you work with a mortgage broker? While banks may seem like the obvious choice, many homebuyers quickly discover that a broker gives them more flexibility, better options, and a smoother process. Here’s why working with a mortgage broker in Queen Creek, AZ (like Brick Mortgage) is often the smartest move.

🏦 Banks Offer Limited Choices

When you walk into a bank, you’re limited to that bank’s mortgage products. It’s like going to a restaurant that only serves one dish—if it doesn’t fit your appetite, you’re out of luck.

Banks:

Push their own loan programs.

Can’t compare other lenders’ rates.

May have rigid approval guidelines that don’t fit every borrower.

🧩 Brokers Offer Flexibility and More Options

Mortgage brokers act as a bridge between you and dozens of lenders. Instead of being stuck with one bank’s menu, a broker shops the market for you. That means:

Access to multiple lenders – Conventional, FHA, VA, USDA, jumbo, and more.

Competitive mortgage rates – Brokers compare offers to find the most favorable terms.

Custom solutions – Whether you’re a first-time homebuyer, a veteran, or buying an investment property, a broker tailors the loan to your needs.

👨💼 Personalized Service vs. Call Centers

Banks are large institutions. That often means dealing with a 1-800 number, endless hold times, or multiple employees who don’t know your full story.

A local mortgage broker, on the other hand, works directly with you through the entire process. At Brick Mortgage, you work with Jared Halbert, not a revolving door of call center staff. Personalized service matters when timelines are tight and communication is critical.

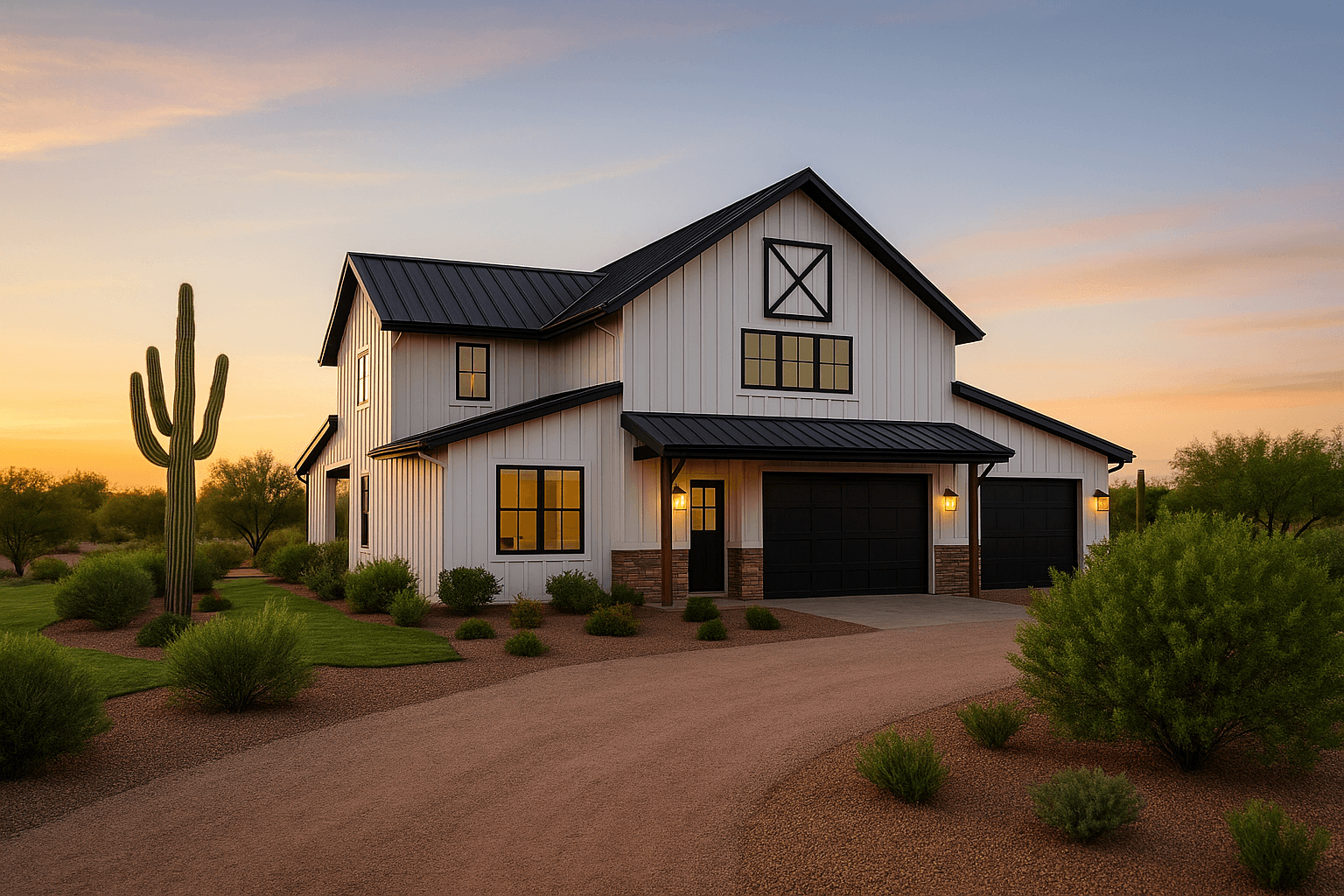

📍 The Local Advantage in Queen Creek, AZ

When you buy a home in Queen Creek, you’re not just purchasing a house—you’re joining a growing community. A local mortgage broker:

Knows Queen Creek’s appraisal trends.

Understands HOA requirements and new-build processes.

Coordinates with local real estate agents and title companies.

This local expertise keeps your loan on track and avoids costly delays.

🎯 The Bottom Line

When buying a home, banks may seem convenient, but mortgage brokers give you more options, better rates, and personal service that a large institution simply can’t match.

📞 Call Jared Halbert at Brick Mortgage today and discover why working with a local mortgage broker in Queen Creek, AZ is the smarter way to finance your new home.