Recent Articles

VA, FHA, and Conventional Loans in Queen Creek, AZ: Which Is Right for You?

Buying a home in Queen Creek, AZ is an exciting step—but choosing the right type of mortgage is just as important as finding the perfect house. Whether you’re a first-time buyer, a veteran, or a homeowner looking to upgrade, understanding the differences between VA, FHA, and Conventional loans will help you make the best decision for your needs.

Published on 10/07/2025

Exploring VA, FHA, and Conventional Loans in Mesa, AZ

Thinking about buying a home in Mesa, AZ? Understanding the different types of mortgage loans available can make the process smoother and help you choose the best option for your situation. Whether you’re a first-time homebuyer, a veteran, or looking to upgrade your family home, let’s break down the most popular loan types—VA, FHA, and Conventional loans—and how each one works right here in Mesa.

Published on 10/06/2025

Mortgages in Queen Creek, AZ: What Homebuyers Need to Know

Looking to buy a home in Queen Creek, AZ? Choosing the right mortgage is one of the most important parts of the process. With so many loan options available, having the right guidance makes all the difference. Here’s what you should know about mortgages in Queen Creek—and why working with a local mortgage broker gives you the edge.

Published on 10/02/2025

Buying a Home in Mesa, AZ: Why Working With the Right Mortgage Broker Matters

Mesa, AZ is one of the most desirable places to live in the East Valley, offering a mix of vibrant neighborhoods, strong schools, and endless opportunities for recreation. If you’re planning to buy a home here, your choice of mortgage partner can make all the difference. Here’s why working with a local mortgage broker in Mesa gives you an advantage when navigating today’s housing market.

Published on 10/01/2025

Mortgage Rates Holds Steady After Weak Jobs Report

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

Why Mortgage Brokers Are Better Than Banks When Buying a House

When you’re buying a home, one of the first big decisions is where to get your mortgage. Do you go straight to your bank, or do you work with a mortgage broker? While banks may seem like the obvious choice, many homebuyers quickly discover that a broker gives them more flexibility, better options, and a smoother process. Here’s why working with a mortgage broker in Queen Creek, AZ (like Brick Mortgage) is often the smartest move.

Published on 09/30/2025

Refinancing a Conventional Home Loan in Queen Creek, AZ

If you own a home in Queen Creek, AZ with a conventional mortgage, refinancing could help you save money, access equity, or restructure your loan to better fit your financial goals. Here’s what homeowners in Queen Creek should know about refinancing a conventional home loan—and why working with a local mortgage broker can make the process smoother.

Published on 09/29/2025

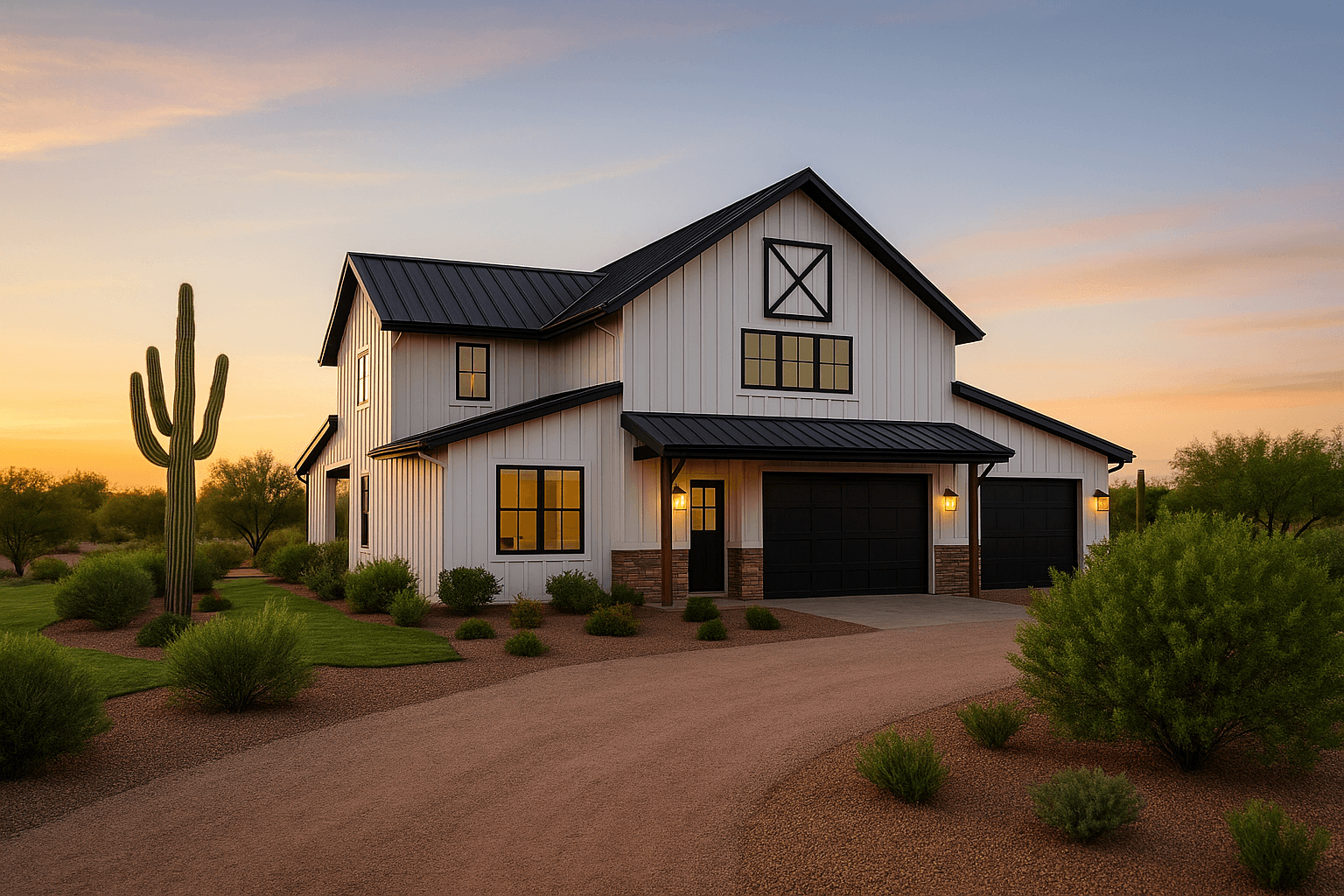

Getting Your Home Ready to Sell in Queen Creek, AZ: What Your Mortgage Broker Needs to Know

Selling your home in Queen Creek, AZ? Preparing your property is about more than curb appeal—it’s also about making sure your mortgage and financing details line up with your goals. Here’s how to get your home ready for sale and what your mortgage broker may need to know before you list.

Published on 09/26/2025

3 Reasons Home Affordability Is Improving This Fall

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025